MERCURY SYSTEMS (MRCY)·Q2 2026 Earnings Summary

Mercury Systems Posts Record Backlog as Free Cash Flow Surges—Stock Jumps 6%

February 3, 2026 · by Fintool AI Agent

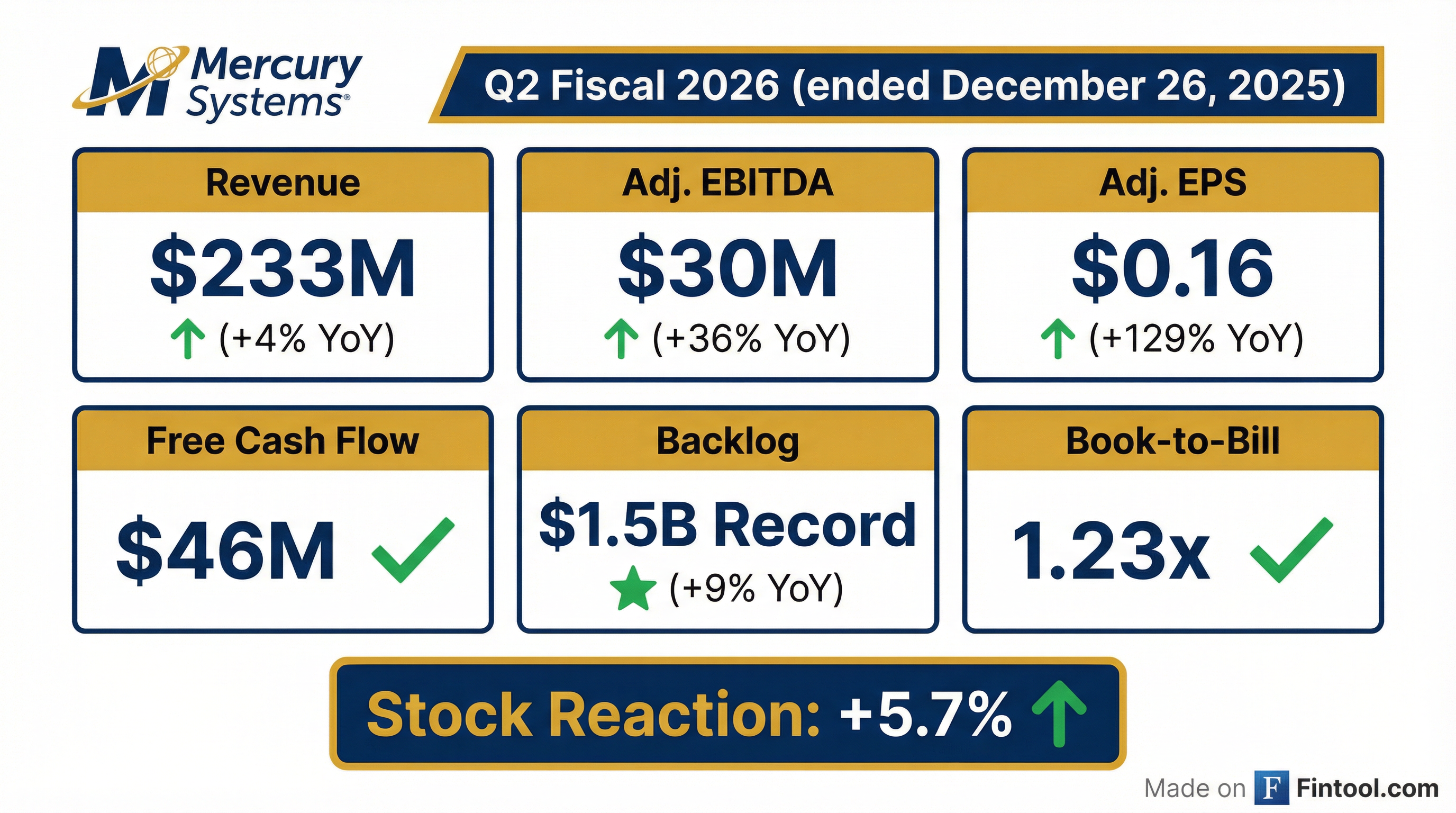

Mercury Systems delivered Q2 FY2026 results that exceeded expectations, posting record first-half revenue and a surge in free cash flow that sent shares up 5.7% to close at $99.28. The defense electronics specialist reported bookings of $288M with a 1.23 book-to-bill ratio, driving backlog to a record $1.5B.

Did Mercury Systems Beat Earnings?

Mercury Systems beat on all key metrics. CEO Bill Ballhaus stated results were "ahead of our expectations, with solid year-over-year growth in backlog, revenue, and adjusted EBITDA, and robust free cash flow."

The company achieved record first-half revenue of $458M, up 7.1% year-over-year.

How Did the Stock React?

Mercury shares surged 5.7% on earnings day, closing at $99.28 versus the prior close of $93.89. The stock is now trading near its 52-week high of $103.84 and has more than doubled from its 52-week low of $39.89. Key drivers of the positive reaction:

- Record backlog of $1.5B provides revenue visibility

- Free cash flow of $46M well ahead of expectations

- Margin expansion of 300 bps YoY despite lower gross margin

- Booking strength with 1.23x book-to-bill

The stock now trades at a market cap of approximately $6.0B, reflecting renewed investor confidence in the turnaround story.

What Did Management Say About Bookings and Backlog?

Mercury secured $288M in Q2 bookings, yielding a 1.23 book-to-bill ratio and pushing total backlog to a record $1.5 billion—up $119M from a year ago. Of this backlog, $807M is expected to convert to revenue within 12 months.

Key contract awards in the quarter included:

- Missile defense expansion: Scope increase on a cost-plus development program for a core missile defense platform

- Advanced air mobility: Major subsystem win for ground control infrastructure with a leading manufacturer

- Space applications: Design award with a leading aerospace prime, expanding Mercury's space market presence

- Production follow-ons: Incremental orders on a key U.S. missile franchise plus naval platform and international radar/EW awards

- Star Lab integration: $20M in awards leveraging Common Processing Architecture with embedded anti-tamper and cybersecurity software

Management noted continued customer discussions on "potential incremental demand across multiple programs, driven by rising global defense budgets and priorities such as Golden Dome."

What Changed From Last Quarter?

*Values retrieved from S&P Global

The sequential improvement was driven by:

- Accelerated deliveries: Management prioritized programs with unbilled receivable balances, driving record first-half point-in-time revenue since FY21

- Net EAC stability: Only ~$4M of net adverse estimate-at-completion adjustments, in line with recent quarters

- Working capital release: Net working capital down $61M year-over-year through better program execution and supply chain management

What Did Management Guide?

FY2026 Full-Year Guidance (Maintained)

Q3 FY26 Outlook

- Revenue: Down year-over-year absent additional delivery accelerations (due to ~$30M Q2 pull-forward)

- Adj. EBITDA Margin: Approaching double digits

- Free Cash Flow: Expected outflow (pulled forward ~$30M of cash receipts into Q2)

Q4 FY26 Outlook

- Adjusted EBITDA margin expected to be the highest of the fiscal year

Long-Term Target Profile

Management reiterated confidence in achieving the target profile over time:

- Revenue Growth: Above market

- Adj. EBITDA Margin: Low-to-mid 20% range

- FCF Conversion: 50%

Importantly, guidance excludes potential upside from accelerated demand driven by domestic priorities like Golden Dome or increased global defense budgets.

What Are the Key Risks?

The company's forward-looking statements highlight several risk factors:

- U.S. government funding: Continued funding of defense programs and timing of appropriations

- Federal government shutdown: Effects of potential shutdown or extended continuing resolution

- Program execution: Production delays, quality issues, or failure to meet contractual specifications

- Backlog margin: Converting low-margin legacy backlog while adding new bookings at target margins

- Geopolitical factors: Supply chain disruption, inflation, and labor shortages impacting execution

Q&A Highlights

When Will Low-Margin Backlog Burn Off?

CEO Bill Ballhaus clarified the timeline: "As we work our way through 2026 and through 2027, we expect to see most of the impact tied to the low margin distribution, our backlog start to burn through and get behind us." CFO Dave Farnsworth emphasized that the low-margin portion shrinks every quarter since "we're not adding new things at low margin."

Common Processing Architecture (CPA) Capacity

On CPA capacity expansion, Ballhaus noted that Phoenix expansion costs are already in OpEx: "The cost associated with that is already in our OpEx, and so the investment that we're making is a little bit of CapEx to bring additional lines on board." Importantly, factories are running single shifts, providing a low-capital path to scale: "For the most part, we're running at single shifts across all of our factories, and so the first step for us to increase capacity to meet tailwinds would be to add additional shifts."

Cash Deployment Priorities

On capital allocation, Farnsworth indicated the target cash balance is $100-150M: "Around $100 million to $150 million is probably the right kind of balance for us." The priority remains delevering: "Our emphasis is still on delevering. That's something we're looking at, obviously, as we go through the next couple of quarters."

Golden Dome and International Pipeline

Ballhaus provided encouraging color on the demand pipeline: "There's a dozen plus programs where we're having conversations with customers around significant increases in quantities. And I would say that if any of those tailwinds were to hit, that would shift our expectations around our ability to hit our target profile and exceed our target profile."

International and FMS revenue was $38M in Q2, approximately 15% of total revenue. Notably, domestic business grew low-teens year-over-year in the first half.

Restructuring Actions

The $4M restructuring charge in Q2 reflected workforce and facilities actions: "That affected about 100 folks and some facilities. So we do expect to see some lift of that as we go through the next year or so."

Supply Chain Execution

On the ability to continue accelerating deliveries, Ballhaus explained the approach: "Literally every week with the teams across every program, we're going through every bill of material line by line and looking at what does it take for us to get kit complete... The reality is, while we're pushing on our suppliers to close out kits, we don't know that the material will be here until the day that it shows up."

Balance Sheet Health

The balance sheet remains healthy with net debt of approximately $257M versus adjusted LTM EBITDA of ~$142M, implying net leverage of ~1.8x.

The Bottom Line

Mercury Systems delivered a clean beat with record backlog, accelerating margin improvement, and free cash flow well ahead of expectations. The 5.7% stock move reflects growing investor confidence in the turnaround thesis. Key catalysts to watch:

- Q3/Q4 execution on margin expansion toward mid-teens

- Golden Dome and defense budget upside not yet in guidance

- Working capital release driving continued FCF improvement

- Backlog conversion as low-margin legacy work rolls off